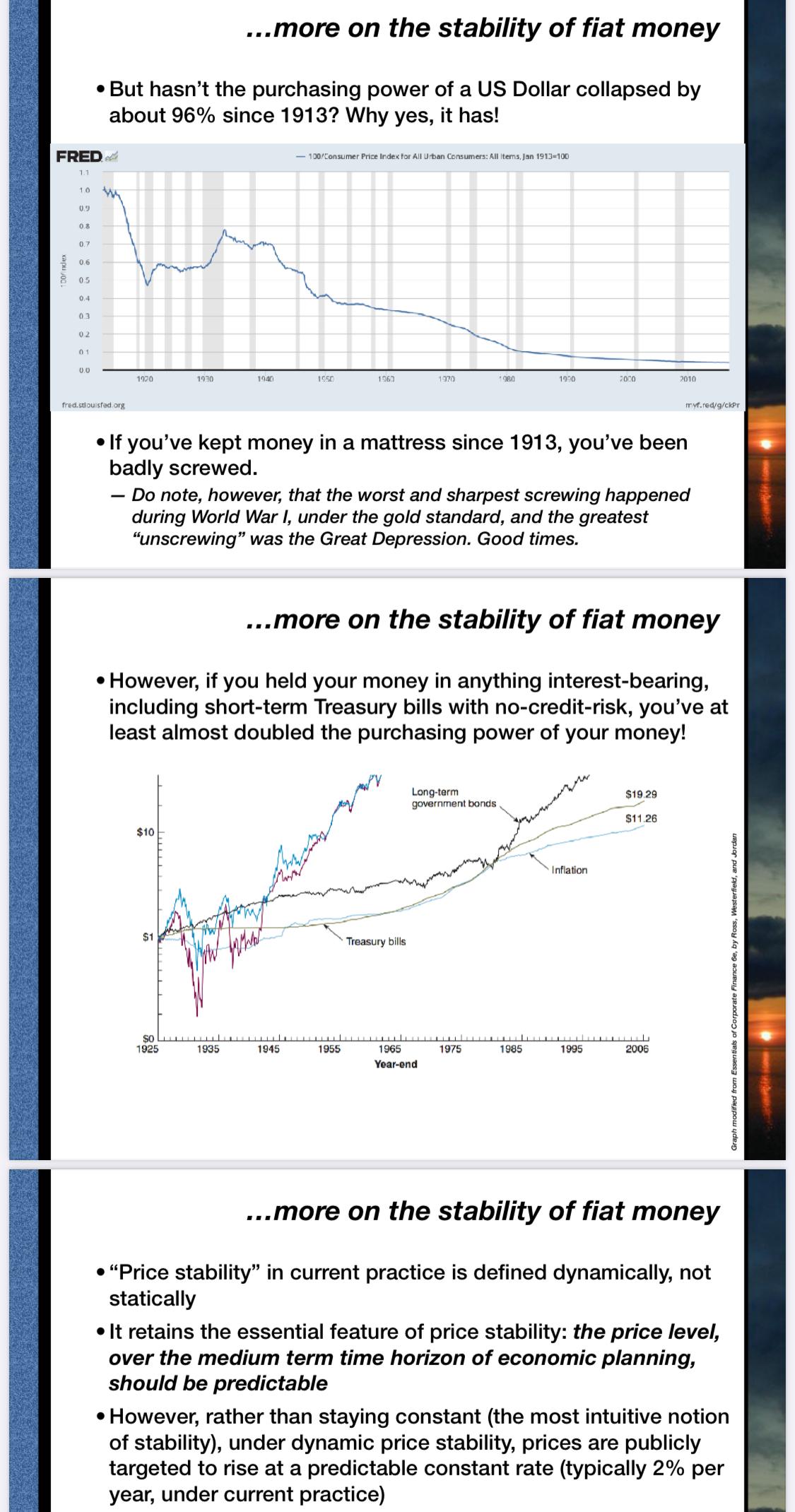

@Phil @realcaseyrollins @diego The dollar was not on remotely a path toward collapse until your movement put it there. Sure, a dollar has lost a lot of value over the last hundred years, if you kept it in a mattress. If you put it anywhere else — earned short-term, credit and interest-rate risk free Treasury bill rates — its value has increased.

From me, https://www.interfluidity.com/uploads/2017/10/Fiat-Is-Effective-Minitalk-light-edit-to-share.pdf 1/

@Phil @realcaseyrollins @diego But there is no coherent case for insisting upon and imposing *bilateral* rather than *overall* trade balance. Which is what this administration has absurdly, destructively, I’m sorry but stupidly, tried to impose. 4/

@Phil @realcaseyrollins @diego The United States should broadly buy roughly as much as it sells. It matters not a whit if it buys more from Lesotho than it sells to Lesotho as long as it sells to somebody else more than it buys from them. 5/

@Phil @realcaseyrollins @diego The overwhelming majority of ways the world could be in overall balance — all countries in overall balance — involve a lot of offsetting bilateral trade imbalances. That is the space we want markets to explore and optimize over. Insisting on bilateral balance between all countries is the international equivalent of barter. You only trade where there is a double coincidence of wants. 6/

@Phil @realcaseyrollins @diego But the Trump Administration wants to personalize international trade into trade partners taking advantage, or ripping us off, when the only party that could have intervened to insure the US remained in overall balance was the US itself, and it would not have been hard, we just didn’t want to do it, persuaded ourselves (wrongly!) that we shouldn’t. 7/

@Phil @realcaseyrollins @diego So it destroys friendships and alliances, and takes down the US economy, by idiotically deploying tariffs intended to immediately bring all trading relationships into bilateral balance. 8/

@Phil @realcaseyrollins @diego If what you want is a world of overall-balanced trade (which you should!), you should be perfectly comfortable with BRICs-ish diversification from the dollar as reserve currency to a wider basket of reserve assets. 9/

@Phil @realcaseyrollins @diego If a single issuer (think country) is to be the reserve currency provider, then it *must* run a current-account (usually trade) deficit, in order to supply the world with the reserve asset it demands.

I suspect you’ve encountered it. This is known as the Triffin Dilemma https://en.wikipedia.org/wiki/Triffin_dilemma?wprov=sfti1# 10/

@Phil @realcaseyrollins @diego My view is that the benefit of a world with overall balanced trade outweighs the benefit to the US of trying to maintain a near monopoly on reserve asset provision, so I prefer we go for overall balance rather than continue to run large deficits to supply the world with dollars. /fin