Unemployment and the credit cycle

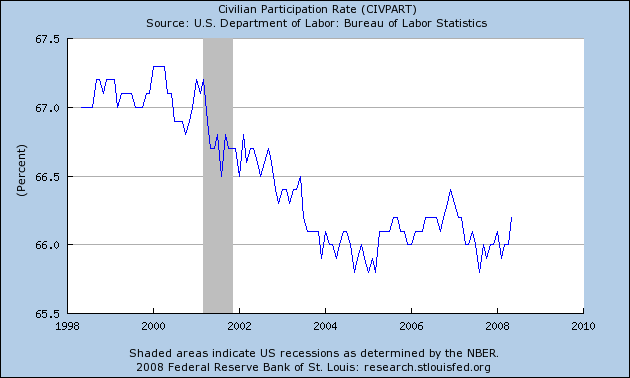

Much of the chatter surrounding the latest BLS release has focused on a spike in the denominator of the unemployment statistic, the fraction of the population either working or actively looking for work. Courtesy of the indispensible FRED…

About a year ago, David Altig (whose macroblogging I miss very much) wrote the following:

[Since 2000] you would be justified in claiming a broad-based decline in the number of people choosing to participate in U.S. labor markets. But I use the word “choosing” intentionally, as I’m convinced that the post-2000 changes in labor force participation rates (or employment-to-population ratios, if you like) reflect trends that are largely independent of the business cycle.

Much turns on the question of why people chose not to participate in the labor force this decade. A “business cycle” explanation, as I read Altig, would mean that people left the labor force because there weren’t employment opportunities. They couldn’t find a job, and became “discouraged workers”, in the lingo. I agree with Altig that this is unlikely. However, unemployment statistics (very uneconomically) ignore price, and stagnant real wages over the period undoubtedly had something to do with the decline in participation. People chose not to work because they decided the money wasn’t worth their time.

But it’s also important to consider a credit cycle explanation for why people left the workforce. One has the luxury of choice when one can afford to do without employment. During a credit expansion, many people have that luxury, because one can live off of borrowing and asset appreciation. You can quit your shitty job and withdraw some home equity while you write the great American novel, focus on your music, or raise your children. You can go to school, even though you lack savings, because student loans are plentiful.

But when credit conditions tighten and asset prices fall, work becomes less optional. Quitting the rat race and pursuing your passion starts to recall the phrase “starving artist”, and not in a charming way. Dad might decide he needs a job to make ends meet, even if that means putting the kids in day care.

Some argue that the US economy is structurally immune from the wrenching spikes in unemployment that used to accompany recessions, because employment has transitioned from volatile manufacturing to more mellow services. See, for example, this excellent analysis from Calculated Risk. CR chooses 8% unemployment as his threshold for a “severe” recession. But the US economy need not lose a single job more to bring unemployment to that level. If participation rose back to the levels of the late 90s without a commensurate increase in new jobs, we’d be there already we’d be at 6.6% unemployment right now. [Note: In my original calculations, I mistakenly entered 68%, rather than 67%, as the late 90s participation rate, significantly exaggerating the effect. My apologies for the error!]

When we ended welfare as we know it, back in the nineties, the slogan “Choose to work” might have captured the spirit of the times. It’s ironic that more than a decade later, the apparent health of the American economy depends largely on how many people continue to choose not to work, now that the credit spigot has dried up.

- 10-June-2008, 12:30 p.m. EDT: Struck an corrected erroneous calculation of 8% unemployment if we returned to late nineties participation. Fixed a period that meant to be a comma.

Steve – A posting over on Naked Capitalism alerted me to the following two stories:

Here

And Here

This past weekend, 175,000 people sat for the CFA exam. Over 40% of them were from Asian countries. Many of those countries are subsidizing the exam takers. “Financial Analyst” will soon be a position outsourced to China for at significant cost savings, just as “Software Engineer” is with India.

In the second story, China is opening its first US-style law school, Peking University School of Transnational Law, and they’ve applied for accreditation from the ABA, so that their graduates can practice law in the US. They’ve also hired Jeffrey Lehman, Cornell Law School professor, and past president of Cornell and past dean of the University of Michigan Law School, to be the dean of the school. Likewise, students will be heavily subsidized.

In my opinion, the living standard of upper middle class college-educated folks in the US is about to take the same beating that working class and lower middle class folks have over the past few decades. In the technology industry, it already started a few years back.

You also mention the credit expansion allowing people to live on borrowed time and money, which is very true. Personal savings rates in the US generally hovered in the 7-9% range from the post-WWII period all the way through 1995, when they slowly declined until effectively hitting 0% around 2005 where they have since remained (and occasionally dipped into negative territory). With the free credit era ending last year, these people will have to either increase their incomes (unlikely) or drastically scale back their living standards.

June 8th, 2008 at 4:06 pm PDT

link

Steve,

I found an interesting article on the debate about Saudia Arabia current account surplus (Via Mish) Shura member calls for oil production curbs in Saudi:

This look surprisingly similar to what I suggested in a comment here a few days ago.

June 8th, 2008 at 4:42 pm PDT

link

When we ended welfare as we know it, back in the nineties, the slogan “Choose to work” might have captured the spirit of the times. It’s ironic that more than a decade later, the apparent health of the American economy depends largely on how many people continue to choose not to work, now that the credit spigot has dried up.

I’m still upset over the elimination of the safety net, although I can understand how it took a Democratic president to do it, rather like it took the red-baiter Nixon to open China.

The worse this recession gets (that is, whenever the “recession” actually begins) the more desperate the people will become. That’s my biggest fear now: blowback against the “system”. More taxes, less free trade, greater regulation, and more immigrant, hedge fund and Federal Reserve bashing. I would have thought a more equitable society and a social safety net were great hedges against political risk. Oh well.

June 8th, 2008 at 5:59 pm PDT

link

Steve, probably two-thirds of the decline in labor force participation rate in the last ten years is due to demographics. Participation drops above the age of 55. I took detailed BLS data from 1997 and compared it with 2007, and tested it by holding participation rates constant by age/sex cohort vs. holding the population shares constant.

Also, BLS has an annual survey in which they ask those not in the labor force in the past year why they didn’t work or look for work. The biggest shift over the last 20+ years (data begins in 1980) is for men listing disability as a reason for not working. It would be interesting to have more detail on what exactly is going on–chronic health issues? post-traumatic stress?

June 8th, 2008 at 10:43 pm PDT

link

Regarding disability. I am 57 involuntary exITer, job went to India. I cannot do hard labor say construction work. There are other work that I cannot due due to age and arthritis. So am I disabled if I cannot find IT work and physical labor is the only option? Also heard an NPT piece years ago that for a lot of folks disability is used to transition chronic UE in the 50s to Social Security at 62 as a sorta of unemployment insurance.

In any case, this will be the first recession where additional debt is not an option in perhaps 20 years. It will be ironic is it turns out that the elimination of the safety net was financed by HELOC, cash out refis and Credit card debt.

June 9th, 2008 at 6:27 am PDT

link

If a person took out a second mortgage and lived on credit as RTD says they have two options increase there income or scale back spending. A third option we are seeing is bankruptcies and repose.

One way to increase a person’s income is to take on a second job. This in effect takes away a job from a person seeking employment because they can do the job for less being that it is not their main source of income.

When interest rates drop the variable rate second mortgages also drops because they’re tied to prime. The payment drops and suddenly the second job is not as vital.

I believe we are seeing these two effects takes place. I expect next quarter unemployment to decrease because the second jobbers will have quite allowing unemployed persons to get those jobs.

June 9th, 2008 at 9:09 am PDT

link

Scott — I don’t think you can explain this away so easily. Holdng participation constant by age/sex cohort is counterfactual. The trend in 55+ has been greater participation. The drop you predict would be a fraction of the significantly larger drop we would have seen had 55+ participation not increased. If you took the actual drop for your denominator, you’re overestimating the effect of aging. Look back at the Altig post. There’s been a very clear decline within prime age cohorts, and a very steep decline in teen participation. The latter is obviously related to a work/school tradeoff, and may largely reflect increasing expected returns to education. But is vulnerable to credit constraints. The decline within prime-age cohorts is harder to explain. Undoubtedly, demographics matters. But it’s not the only factor, and I don’t think it adequately explains the drop.

Surveyed disability is again hard to interpret. As vader points out, disability is relative to occupational choices, which are also related to pay. A person who leaves the work force because the jobs he can do no longer exist or no longer pay well might well claim disability as a motive. It’s hard to make the case that the decline in participation was due to an objective increase in disability among men (much of the trend had already played out by the time the Iraq war had begun), other than perhaps via aging.

It’s easy for me to cast shadows, and cheap, since you did actual work on this, and I just looked at someone’s webpage. I may be totally offbase in suggesting that credit availability explains much of the drop. Fortunately or unfortunately, we’ll probably learn pretty soon just how important easy credit has been to labor force nonparticipation.

Avg Joe — I’m not sure that I buy the idea that there’ll be a wave of second job quitting as ARM rates reset down. It could happen, but the economic environment seems stressful in general, food and fuel prices are higher, etc. My guess is people who were stressed enough to take a second job will mostly stay stressed enough to keep it.

Thanks all for the interesting pointers, some of which I hadn’t seen. And let’s try not to be too melancholy. There must be some kind of way out of here, and hopefully we’ll figure it out.

June 9th, 2008 at 1:31 pm PDT

link

graph of home equity withdrawal and consumption as % of GDP

June 9th, 2008 at 3:14 pm PDT

link

Steve, thanks for your reply. Let me try again. I compared April 1998 population and April 2008 population by age and sex. What if there had been no change in demographics? That is, what if each age/sex cohort had the same percentage of total population? Then apply April 2008 labor force participation rates to that adjusted population, sum across all cohorts, and divide by total population (16 and older civilian noninstitutionalized). The result: the overall labor force participation rate would be 66.4 percent, instead of the actual 65.7. The decline would only be two tenths of a point from April 1998, not nine tenths of a point. So your assertion that if participation rates were the same as ten years ago, we’d have 8 percent unemployment, is true only if we ignore the aging of the population.

June 10th, 2008 at 12:23 am PDT

link

Scott — OK. That’s a different experiment than I thought you’d done. (I thought you’d held 1998 participation by age/cohort constant and calculated participation under current demographics.) So, if demographics had not changed, but intracohort participation had changed to April ’08 levels, we’d have fallen from 67% to 66.4% participation. Then, suddenly we all age, and participation drops to the actual April ’08 level of 66% (according to Fred, are we working off different numbers?). I’m getting from this experiment 60% of the decline due to intracohort participation rates, and 40% due to demographics. But, if we take 65.7% as April participation, we’d have a roughly 50:50 split.

I’ll write more, but while thinking this through, I double checked my math on the original post, and found a doozy of an arithmetic error. I’m gonna make a fast quick, prominent correction, then I’ll get back to this.

June 10th, 2008 at 11:22 am PDT

link

OK, then… we’re agreed that the 8% figure is bullshit.

If, holding 1998 demographics constant, participation would have been 66.4% in April, by my reckoning, we’d have seen a 0.4% drop in participation due to aging. So, we should have been at 66.4% participation in April, or (very evilly) at 66.6% participation today, had in cohort participation rates not fallen. That would put the unemployment rate at 6.06% today if we assume participation rates revert within cohorts, but demographic effects hold. Fair enough.

Note, though, that this isn’t an upper bound on participation-driven unemployment. My core argument is that, absent easy credit, an inability to dissave, or even to convert volatile earnings into smooth consumption, will lead many labor force drop outs (as well as various self-employeds) to become active jobseekers. I know it sounds like double-dipping, but I’d suggest, for example, that 55+ participation would not revert down, while prime and teen participation would revert up. Obviously, that’s only conjecture. Again, fortunately and unfortunately, whatever will be will play out before our eyes soon enough.

June 10th, 2008 at 12:34 pm PDT

link

Steve, agreed, fortunately or unfortunately, it will be interesting to see how things play out.

June 12th, 2008 at 1:09 am PDT

link