This is the fourth part of a series. See parts 1, 2, 3, and 5. Comments are open on this post.

What good are markets anyway? Why should we rely upon them to make economic decisions about what gets produced and who gets what, rather than, say, voting or having an expert committee study the matter and decide? Is there a value-neutral, “scientific” (really “scientifico-liberal“) case for using markets rather than other mechanisms? Informally, we can have lots of arguments. One can argue that most successful economies rely upon market allocation, albeit to greater and lesser degrees and with a lot of institutional diversity. But that has not always been the case, and those institutional differences often swamp the commonalities in success stories. How alike are the experiences of Sweden, the United States, Japan, current upstarts like China? Is the dominant correlate of “welfare” really the extensiveness of market allocation, or is it the character of other institutions that matters, with markets playing only a supporting role? Maybe the successes are accidental, and attributing good outcomes to this or that institution is letting oneself be “fooled by randomness“. History might or might not make a strong case for market economies, but nothing that could qualify as “settled science”.

But there is an important theoretical case for the usefulness of markets, “scientific” in the sense that the only subjective value it enshrines is the liberal presumption that what a person would prefer is ipso facto welfare-improving. This scientific case for markets is summarized by the so-called “welfare theorems“. As the name suggests, the welfare theorems are formalized mathematical results based on stripped-down and unrealistic models of market economies. The ways that real economies fail to adhere to the assumptions of the theorems are referred to as “market failures”. For example, in the real world, consumers don’t always have full information; markets are incomplete and imperfectly competitive; and economic choice is entangled with “externalities” (indirect effects on people other than the choosers). It is conventional and common to frame political disagreements around putative market failures, and there’s nothing wrong with that. But for our purposes, let’s set market failures aside and consider the ideal case. Let’s suppose that the preconditions of the welfare theorems do hold. Exactly what would that imply for the role of markets in economic decisionmaking?

We’ll want to consider two distinct problems of economic decisionmaking, Pareto-efficiency and distribution. Are there actions that can be taken which would make everyone better off, or at least make some people better off and nobody worse off? If so, our outcome is not Pareto efficient. Some unambiguous improvement from the status quo remains unexploited. But when one person’s gain (in the sense of experiencing a circumstance she would prefer over the status quo) can only be achieved by accepting another person’s loss, who should win out? That is the problem of distribution. The economic calculation problem must concern itself with both of those dimensions.

We have already seen that there can be no value-neutral answer to the distribution problem under the assumptions of positive economics + liberalism. If we must weigh two mutually exclusive outcomes, one of which would be preferred by one person, while the other would be preferred by a second person, we have no means of making interpersonal comparisons and deciding what would be best. We will have to invoke some new assumption or authority to choose between alternatives. One choice is to avoid all choices, and impose as axiom that all Pareto efficient distributions are equally desirable. If this is how we resolve the problem, then there is no need for markets at all. Dictatorship, where one person directs all of an economy’s resources for her own benefit, is very simple to arrange, and, under the assumptions of the welfare theorems, will usually lead to a Pareto optimal outcome. (In the odd cases where it might not, a “generalized dictatorship” in which there is a strict hierarchy of decision makers would achieve optimality.) The economic calculation problem could be solved by holding a lottery and letting the winner allocate the productive resources of the economy and enjoy all of its fruits. Most of us would judge dictatorship unacceptable, whether imposed directly or arrived at indirectly as a market outcome under maximal inequality. Sure, we have no “scientific” basis to prefer any Pareto-efficient outcome over any other, including dictatorship. But we also have no basis to claim all Pareto-efficient distributions are equivalent.

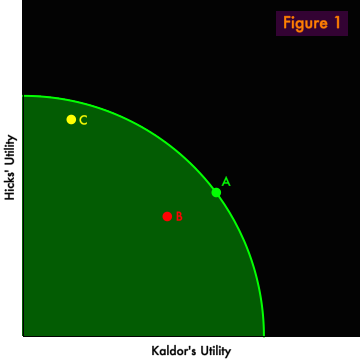

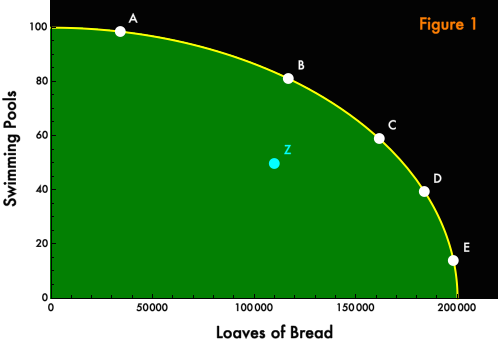

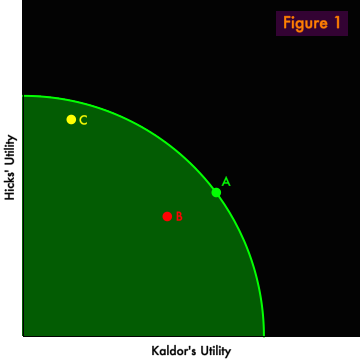

Importantly, we have no basis even to claim that all Pareto-efficient outcomes are superior to all Pareto-inefficient distributions. For example, in Figure 1, Point A is Pareto-efficient and rankably superior to Pareto-inefficient Point B. Both Kaldor and Hicks prefer A over B. But we cannot say whether Point A is superior or inferior to Point C, even though Point A is Pareto-efficient and Point C is not. Kaldor prefers Point A but Hicks prefers Point C, its Pareto-inefficiency notwithstanding. The two outcomes cannot be ranked.

We are simply at an impasse. There is nothing in the welfare theorems, no tool in welfare economics generally, by which to weigh distributional questions. In the next (and final) installment of our series, we will try to think more deeply about how “economic science” might be put to helpfully address the question without arrogating to itself the role of Solomon. But for now, we will accept the approach that we have already seen Nicholas Kaldor and John Hicks endorse: Assume a can opener. We will assume that there exist political institutions that adjudicate distributional tradeoffs. In parliaments and sausage factories, the socially appropriate distribution will be determined. The role of the economist is to be an engineer, Keynes’ humble dentist, to instruct on how to achieve the selected distribution in the most efficient, welfare-maximizing way possible. In this task, we shall see that the welfare theorems can be helpful.

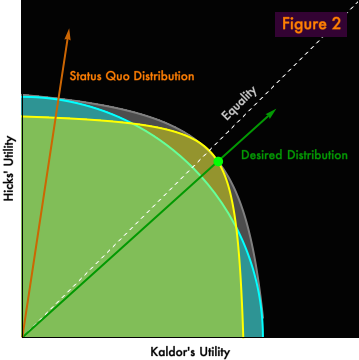

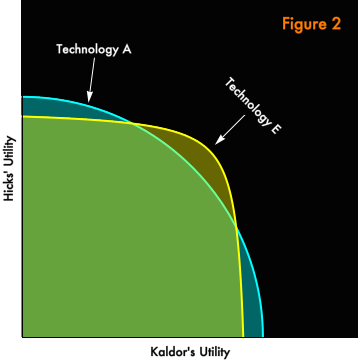

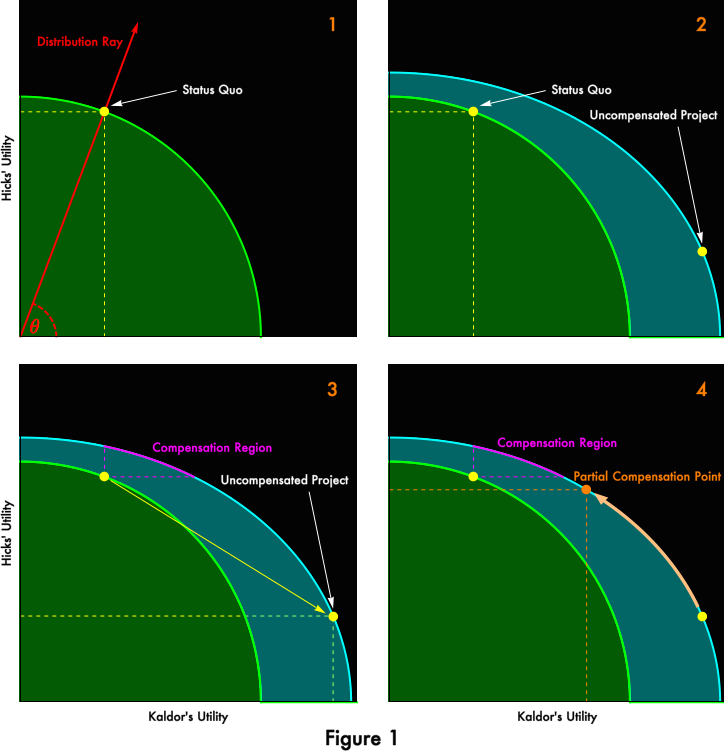

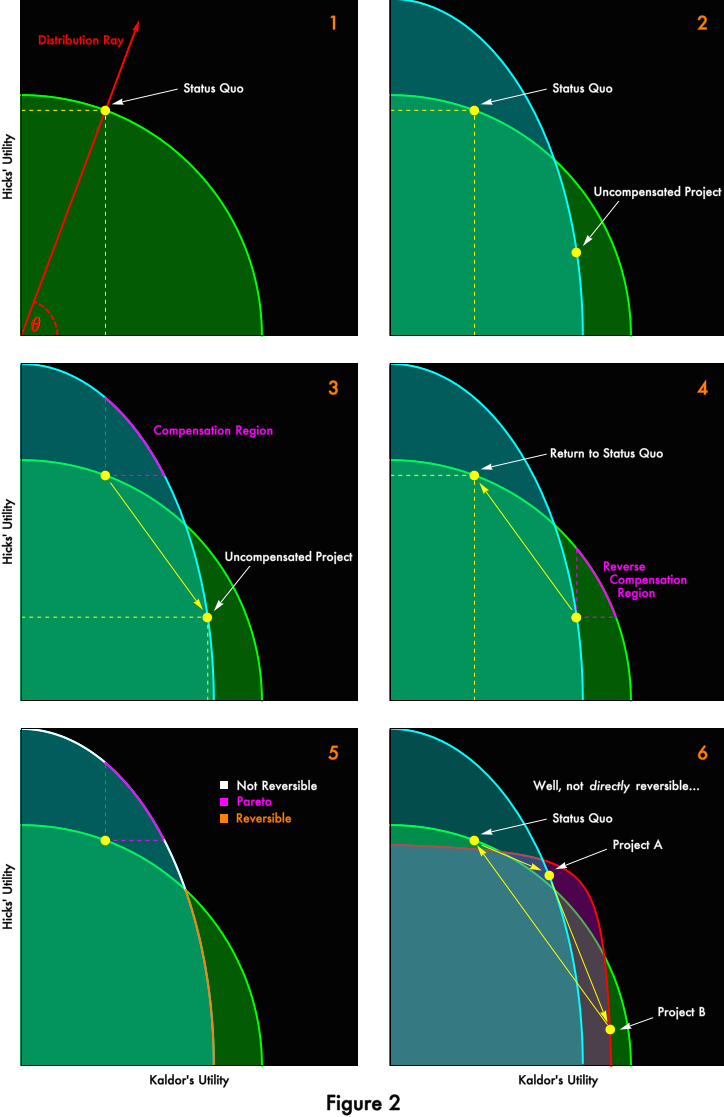

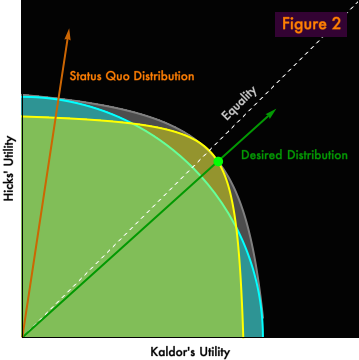

Figure 2 is a re-presentation of the two-person economy we explored in the previous post. Kaldor and Hicks have identical preferences, under a production function where different distributions will lead to deployment of different technologies. In the previous post, we explored two technologies, discrete points on the production possibilities frontier, and we will continue to do so here. However, we’ve added a light gray halo to represent the continuous envelope of all possible technologies. (The welfare theorems presume that such a continuum exists. The halo represents the full production possibilities frontier from the Figure 1 of the previous post. The yellow and light blue curves represent specific points along the production frontier.) Only two technologies will concern us because only two distributions will concern us. There is the status quo distribution, which represented by the orange ray. But the socially desired distribution is represented by the green ray. Our task, as dentist-economists, is to bring the economy to the green point, the unique Pareto-optimal outcome consistent with the socially desired distribution.

If economic calculation were easy, we could just make it so. Acting as benevolent central planners, we would select the appropriate technology, produce the set of goods implied by our technology choice, and distribute those goods to Kaldor and Hicks in Pareto-efficient quantities consistent with our desired distribution. But we will concede to Messrs. von Mises and Hayek that economic calculation is hard, that as central planners, however benevolent, we would be incapable of choosing the correct technology and allocating the goods correctly. Those choices depend upon the preferences of Kaldor and Hicks, which are invisible and unknown to us. Even if we could elicit consumer preferences somehow, our calculation would become very complex in an economy containing many more than two people and a near infinity of goods. We’d probably screw it up.

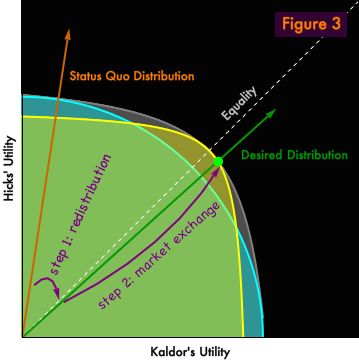

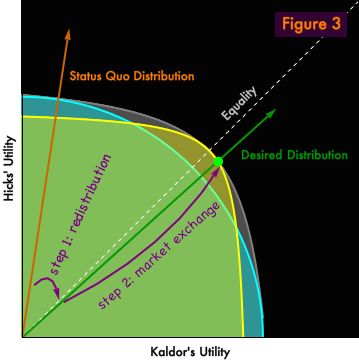

Enter the welfare theorems. The first welfare theorem tells us that, in the absence of “market failure” conditions, free trade under a price system will find a Pareto-efficient equilibrium for us. The second welfare theorem tells us that for every point in the “Pareto frontier”, there exists a money distribution such that free trade under a price system will take us to this point. We have been secretly using the welfare theorems all along, ever since we defined distributions as rays, fully characterized by an angle. Under the welfare theorems, we can characterize distributions in terms of money rather than worrying about quantities of specific goods, and we can be certain that each point on a Pareto frontier will map to a distribution, which motivates the geographic representation as rays. The second welfare theorem tells us how to solve our economic calculation problem. We can achieve our green goal point in two steps. (Figure 3) First, we transfer money from Hicks to Kaldor, in order to achieve the desired distribution. Then, we let Kaldor and Hicks, buy, sell, and trade as they will. Price signals will cause competitive firms to adopt the optimal technology (represented by the yellow curve), and the economy will end up at the desired green point.

The welfare theorems are often taken as the justification for claims that distributional questions and market efficiency can be treated as “separate” concerns. After all, we can choose any distribution, and the market will do the right thing. Yes, but the welfare theorems also imply we must establish the desired distribution prior to permitting exchange, or else markets will do precisely the wrong thing, irreversibly and irredeemably. Choosing a distribution is prerequisite to good outcomes. Distribution and market efficiency are about as “separable” as mailing a letter is from writing an address. Sure, you can drop a letter in the mail without writing an address, or you can write an address on a letter you keep in a drawer, but in neither case will the letter find its recipient. The address must be written on the letter before the envelope is mailed. The fact that any address you like may be written on the letter wouldn’t normally provoke us to describe these two activities as “separable”.

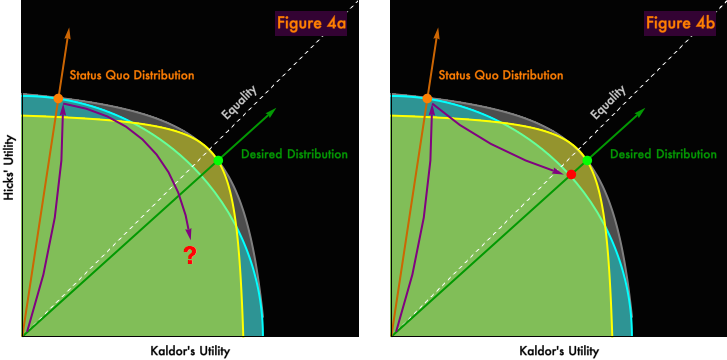

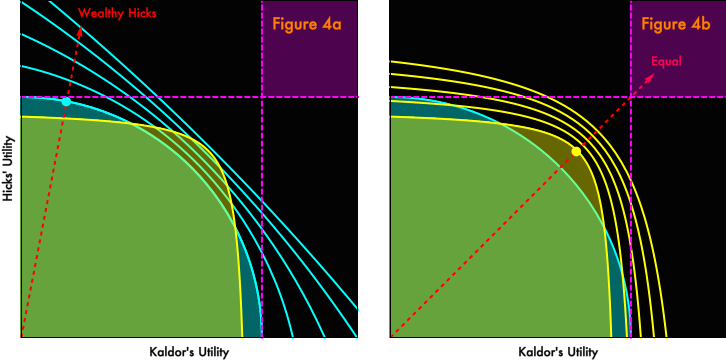

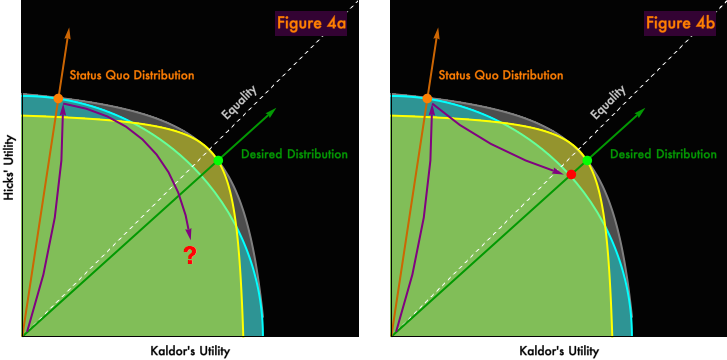

Figure 4 illustrates the folly of the reverse procedure, permitting market exchange and then setting a distribution.

In both panels, we first let markets “do their magic”, which take us to the orange point, the Pareto-efficient point associated with the status quo distribution. Then we try to redistribute to the desired distribution. In Panel 4a, we face a very basic problem. The whole reason we required markets in the first place was because we are incapable of determining Pareto-efficient distributions by central planning. So, if we assume that we have not magically solved the economic calculation problem, when we try to redistribute in goods ex post (rather than in money ex ante), we are exceedingly unlikely to arrive at a desirable or Pareto efficient distribution. In Panel 4b, we set aside the economic calculation problem, and presume that we can, somehow, compute the Pareto-efficient distribution of goods associated with a distribution. But we’ll find that despite our remarkable abilities, the best that we can do is redistribute to the red point, which is Pareto-inferior to the should-be-attainable green point. Why? Because, in the process of market exchange, we selected the technology optimal for the status quo distribution (the light blue curve) rather than the technology optimal for the desired distribution (the yellow curve). Remember, our choice of “technology” is really the choice of which goods get produced and in what quantities. Ex post, we can only redistribute the goods we’ve actually produced, not the goods we wish we would have produced. There is no way to get to the desired green point unless we set the distribution prior to market exchange, so that firms, guided by market incentives, select the correct technology.

The welfare theorems, often taken as some kind of unconditional paean to markets, tell us that market allocation cannot produce a desirable Pareto-efficient outcome unless we have ensured a desirable distribution of money and initial endowments prior to market exchange. Unless you claim that Pareto-efficient allocations are lexicographically superior to all other allocations, that is, unless you rank any Pareto-efficient allocation as superior to all not Pareto-efficient distributions — an ordering which reflects the preferences of no agent in the economy — unconditional market allocation is inefficient. That is to say, unconditional market allocation is no more or less efficient than holding a lottery and choosing a dictator.

In practice, of course, there is no such thing as “before market allocation”. Markets operate continuously, and are probably better characterized by temporary equilibrium models than by a single, eternal allocation. The lesson of the welfare theorems, then, is that at all times we must restrict the distribution of purchasing power to the desired distribution or (more practically) to within an acceptable set of distributions. Continuous market allocation while the pretransfer distribution stochastically evolves implies a regime of continuous transfers in order to ensure acceptable outcomes. Otherwise, even in the absence of any conventional “market failures”, markets will malfunction. They will provoke the production of a mix of goods and services that is tailored to a distribution our magic can opener considers unacceptable, goods and services that can not in practice or in theory be redistributed efficiently because they poorly suited to more desirable distributions.

By the way, if you think that markets themselves should choose the distribution of wealth and income, you are way off the welfare theorem reservation. The welfare theorems are distribution preserving, or more accurately, they are distribution defining — they give economic meaning to money distributions by defining a deterministic mapping from those distributions to goods and services produced and consumed. Distributions are inputs to a process that yields allocations as outputs. If you think that the “free market” should be left alone to determine the distribution of wealth and income, you may or may not be wrong. But you can’t pretend the welfare theorems offer any help to your case.

There is nothing controversial, I think, in any of what I’ve written. It is all orthodox economics. And yet, I suspect it comes off as very different from what many readers have learned (or taught). The standard introductory account of “market efficiency” is a parade of plain fallacies. It begins, where I began, with market supply and demand curves and “surplus”, then shows that market equilibria maximize surplus. But “surplus”, defined as willingness to pay or willingness to sell, is not commensurable between individuals. Maximizing market surplus is like comparing 2 miles against 12-feet-plus-32-millimeters, and claiming the latter is longest because 44 is bigger than 2. It is “smart” precisely in the Shel Siverstein sense. More sophisticated catechists then revert to a compensation principle, and claim that market surplus is coherent because it represents transfers that could have been made, the people whose willingness to pay is measured in miles could have paid off the people whose willingness to pay is measured in inches, leaving everybody better off. But, as we’ve seen, hypothetical compensation — the principle of “potential Pareto improvements” — does not define an ordering of outcomes. Even actual compensation fails to redeem the concept of surplus: the losers in an auction, paid-off much more than they were willing to pay for an item as compensation for their loss, might be willing to return the full compensation plus their original bid to gain the item, if their original bid was bound by a hard budget constraint, or (more technically) did not reflect an interior solution to their constrained maximization problem. No use of surplus, consumer or producer, is coherent or meaningful if derived from market (rather than individual) supply or demand curves, unless strong assumptions are made about transactors’ preferences and endowments. The welfare theorems tell us that market allocations will not produce outcomes that are optimal for all distributions. If the distribution of wealth is undesirable, markets will misdirect capital and make poor decisions with respect to real resources even while they maximize perfectly meaningless “surplus”.

So, is there a case for market allocation at all, for price systems and letting markets clear? Absolutely! The welfare theorems tell us that, if we get the distribution of wealth and income right, markets can solve the profoundly difficult problem of converting that distribution into unfathomable multitudes of production and consumption decisions. The real world is more complex than the maths of welfare theorems, and “market failures” can muddy the waters, but that is still a great result. The good news in the welfare theorems is that markets are powerful tools if — but only if — the distribution is reasonable. There is no case whatsoever for market allocation in the absence of a good distribution. Alternative procedures might yield superior results to a bad Pareto optimum under lots of plausible notions of superior.

There are less formal cases for markets, and I don’t necessarily mean to dispute those. Markets are capable of performing the always contentious task of resource allocation with much less conflict than alternative schemes. Market allocation with tolerance of some measure of inequality seems to encourage technological development, rather than the mere technological choice foreseen by the welfare theorems. In some institutional contexts, market allocation may be less corruptible than other procedures. There are lots of reasons to like markets, but the virtue of markets cannot be disentangled from the virtue of the distributions to which they give effect. Bad distributions undermine the case for markets, or for letting markets clear, since price controls can be usefully redistributive.

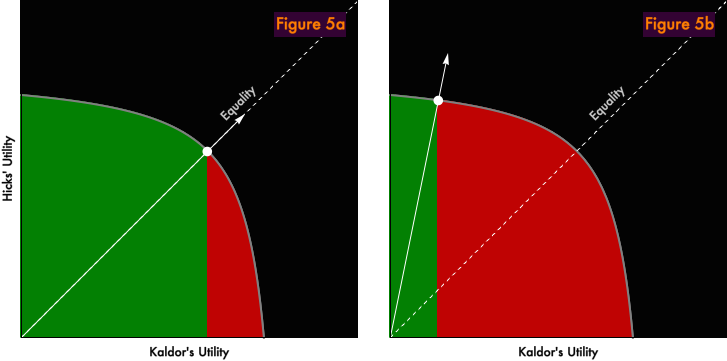

How to think about “good” or “bad” distributions will be the topic of our final installment. But while we still have our diagrams up, let’s consider a quite different question, market legitimacy. Under what distributions will market allocation be widely supported and accepted, even if we’re not quite sure how to evaluate whether a distribution is “right”? Let’s conduct the following thought experiment. Suppose we have two allocation schemes, market and random. Market allocation will dutifully find the Pareto-efficient outcome consistent with our distribution. Random allocation will place us at an arbitrary point inside our feasible set of outcomes, with uniform probability of landing on any point. Under what distributions would agents in our economy prefer market to random allocation?

Let’s look at two extremes.

In Panel 5a, we begin with a perfectly equal distribution. The red area delineates a region of feasible outcomes that would be superior to the market allocation from Kaldor’s perspective. The green area marks the region inferior to market allocation. The green area is much larger than the red area. Under equality, Kaldor strongly prefers market allocation to alternatives that tend to randomize outcomes. “Taking a flyer” is much more likely to hurt Kaldor than to help him.

In Panel 5b, Hicks is rich and Kaldor is poor under the market allocation. Now things are very different. The red region is much larger than the green. Throwing some uncertainty into the allocation process is much more likely to help Kaldor than to hurt. Kaldor will rationally prefer schemes that randomize outcomes in favor of determinstic market allocation. He will prefer such schemes knowing full well that it is unlikely that a random allocation will be Pareto efficient. You can’t eat Pareto efficiency, and the only Pareto-efficient allocation on offer is one that’s worse for him than rolling the dice. If Kaldor is a rational economic actor, he will do his best to undermine and circumvent the market allocation process. Note that we are not (necessarily) talking about a revolution here. Kaldor may simply support policies like price ceilings, which tend to randomize who gets what amid oversubscribed offerings. He may support rent control and free parking, and oppose congestion pricing. He may prefer “fair” rationing of goods by government, even of goods that are rival, excludable, informationally transparent, and provoke no externalities. Kaldor’s behavior need not be taken as a comment on the virtue or absence of virtue of the distribution. It is what it is, a prediction of positive economics, rational maximizing.

Of course, if Kaldor alone is unhappy with market allocation, his hopes to randomize outcomes are unlikely to have much effect (unless he resorts to outright crime, which can be rendered costly by other channels). But in a democratic polity, market allocation might become unsupportable if, say, the median voter found himself in Kaldor’s position. Now we come to conjectures that we can try to quantify. How much inequality-not-entirely-in-his-interest would Kaldor tolerate before turning against markets? What level of wealth must the median voter have to prevent a democratic polity from working to circumvent and undermine market allocation?

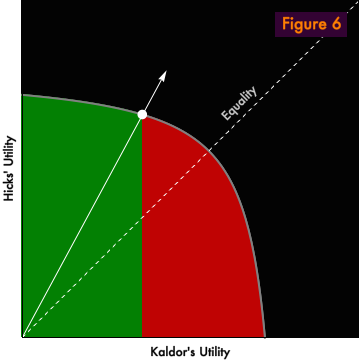

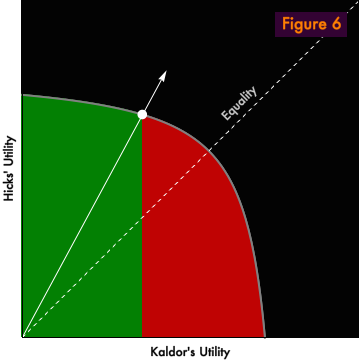

Perfect equality is, of course, unnecessary. Figure 6, for example, shows an allocation in which Kaldor remains much poorer than Hicks, yet Kaldor continues to prefer the market allocation to a random outcome.

We could easily compute from our diagram the threshold distribution below which Kaldor prefers random to market allocation, but that would be pointless since we don’t live in a two-person ecomomy with a utility possibilities curve I just made up. With a little bit of math [very informal: pdf nb], we can show that for an economy of risk-neutral individuals with identical preferences under constant returns to scale, as the number of agents goes to infinity the threshold value beneath which random allocation is preferred to the market tends to about 69% of mean income. (Risk neutrality implies constant marginal utility, enabling us map to from utility to income.) That is, people in our simplified economy support markets as long as they can claim at least 69% of what they would enjoy under an equal distribution. This figure is biased upwards by the assumption of risk-neutrality, but it is biased downwards by the assumption of constant returns to scale. Obviously don’t take the number too seriously. There’s no reason to think that the magnitude of the biases are comparable and offsetting, and in the real world people have diverse preferences. Still, it’s something to think about.

According the the Current Population Survey, at the end of 2012, median US household income was 71.6% of mean income. But the Current Population Survey fails to include data about top incomes, and so its mean is an underestimate. The median US household likely earns well below 69% of the mean.

If it is in fact the case that the median voter is coming to rationally prefer random claims over market allocation, one way to support the political legitimacy of markets would be to compress the distribution, to reduce inequality. Another approach would be to diminish the weight in decision-making of lower-income voters, so that the median voter is no longer the “median influencer” whose preferences are reflected by the political system.

Note: There will be one more post in this series, but I won’t get to it for at least a week, and I’ve silenced commenters for way too long. Comments are (finally!) enabled. Thank you for your patience and forbearance.